Understanding Withholding Tax on Nigerian Treasury Bills

Investing in treasury bills has become a popular topic among Nigerian investors, particularly with the recent rise in interest rates. However, there seems to be confusion regarding withholding tax on these investments. This blog post aims to clarify the current status of withholding tax on Nigerian treasury bills, based on recent experiences and insights gathered from the investment community.

Overview of Treasury Bills in Nigeria

Treasury bills are short-term securities issued by the Nigerian government to help manage its finances. They are typically attractive due to their relatively high-interest rates compared to other investment options. However, the conversation around withholding tax has raised questions among investors about their actual returns.

Historical Context of Withholding Tax

For a significant period from 2012 to 2022, treasury bills were exempt from withholding tax. This exemption was established during the administration of former President Goodluck Jonathan and remained in place during President Muhammadu Buhari’s tenure. However, this tax exemption expired on January 1, 2022, and since then, withholding tax has been applicable to treasury bills in Nigeria.

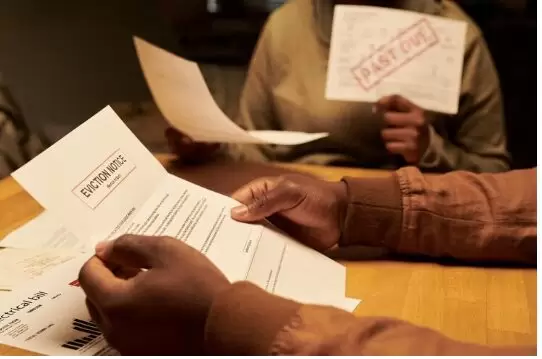

Recent Confusion Among Investors

Recent comments and discussions among investors indicate a misunderstanding of the current tax obligations surrounding treasury bills. Many investors believe that there is still no withholding tax on these securities, likely due to the previous exemption. A review of comments on investment channels shows that most investors are not aware that the exemption has ended, prompting concerns about the accuracy of their investment strategies.

Clarification on Current Tax Regulations

According to a directive from the Federal Inland Revenue Service, withholding tax is now applicable to various short-term government securities, including treasury bills and promissory notes. The tax is levied on interest earned from these investments, which has become a crucial consideration for those investing in treasury bills in 2024.

Investing in Treasury Bills: A Personal Experience

To understand the implications of this tax on individual investments, I recently invested in treasury bills. The process involved a minimum investment of 1 million naira, with a discounted rate of 20.85% for a one-year tenor. The interest earned was approximately 207,000 naira, from which a 10% withholding tax was deducted, amounting to around 20,000 naira. This reduction in net interest raises questions about the overall return on investment compared to other options available, like FGN savings bonds.

Comparison with FGN Savings Bonds

While treasury bills offer competitive interest rates, investing in FGN savings bonds presents an alternative for long-term investors. FGN savings bonds are exempt from withholding tax and typically have longer tenors, providing a steady income stream without the immediate tax implications present in treasury bills.

Conclusion

Investing in Nigerian treasury bills offers potential returns, but it’s crucial for investors to be aware of the current tax landscape. The expiration of the withholding tax exemption means that investors must factor this into their decision-making process. It is advisable for investors to review their investment statements regularly and seek clarity from their financial institutions regarding any applicable charges.

As the investment landscape continues to evolve, staying informed is vital for making sound financial decisions. Engaging with fellow investors and sharing insights can enhance understanding and help navigate the complexities of the Nigerian investment environment.